||

Managers in the 20th century often served as their own payroll hours calculators. That meant extensive time spent manually number-crunching using paper, pencil, and a calculator or adding machine.

Today, technology has advanced enough that many managers now rely on software to do the math for them. It is, however, still essential to know what goes into the process of calculating each employee’s work hours for the pay period.

To that end, in this article, we’ll discuss the steps involved in running your own payroll hours calculator, give you tips for making it more accurate, and then introduce you to technology that does all the math for you.

Payroll Hours Calculator

1) Calculate Total Hours Worked

The first step in the payroll hours calculating process is to add up the total hours an employee worked during your business’s pay period.

There are two ways to do this: with actual time or rounded time.

Actual Time

Using actual time to calculate the total hours worked means using the exact numbers recorded on the employee’s timesheet (be it digital or of the paper variety).

For example, imagine that your employee, Miranda, has turned in the following time card for the workweek:

- Monday: 9:00 a.m. to 5:15 p.m.

- Tuesday: 8:55 a.m. to 5:05 p.m.

- Wednesday: 9:05 a.m. to 5:09 p.m.

- Thursday: 8:58 a.m. to 5:02 p.m.

- Friday: 9:03 a.m. to 5:07 p.m.

With that information, you would first determine how many hours she worked each day.

- Monday: 8 hours 15 minutes

- Tuesday: 8 hours 10 minutes

- Wednesday: 8 hours 4 minutes

- Thursday: 8 hours 4 minutes

- Friday: 8 hours 4 minutes

The easiest way to find the total hours worked for the week is to add up all the hours and then add up all the minutes.

Hours Worked = 8 + 8 + 8 + 8 + 8

Hours Worked = 40

Minutes Worked = 15 + 10 + 4 + 4 + 4

Minutes Worked = 37

So, the total hours worked for the pay period is 40 hours and 37 minutes.

The thing is, you can’t use that number to calculate gross pay because it’s not in decimal format. That comes in step two.

Rounded Time

Using rounded time as part of your payroll calculations can make the math a bit easier to contend with, but there are strict federal laws that govern the practice.

Here are the basic rules:

- You cannot round to more than 15-minute intervals (i.e., X:00, X:15, X:30, and X:45)

- Time values of one minute to seven minutes above those intervals are rounded down

- Time values of eight minutes to 14 minutes above those intervals are rounded up

Recorded times such as 9:07 a.m., 9:22 a.m., and 9:37 a.m. are rounded down to the nearest 15-minute interval (9:00 a.m., 9:15 a.m., and 9:30 a.m., respectively).

Recorded times such as 9:08 a.m., 9:23 a.m., and 9:38 a.m. are rounded up to the nearest 15-minute interval (9:15 a.m., 9:30 a.m., and 9:45 a.m., respectively).

So, if we use Miranda’s time card from the previous section and apply the rounding rules, we get:

- Monday: 8 hours 15 minutes

- Tuesday: 8 hours 15 minutes (rounded up from 10)

- Wednesday: 8 hours (rounded down from 4)

- Thursday: 8 hours (rounded down from 4)

- Friday: 8 hours (rounded down from 4)

When we add all those numbers together, the total hours worked for the pay period (using rounded time) comes out to 40 hours and 30 minutes.

Just like the actual time mentioned earlier, you can’t use that number to calculate gross pay. You have to convert it to decimal format first.

Let’s take a look at how this works.

2) Convert All Time To Decimal Format In Your Payroll Hours Calculator

Because the wage you pay your employees is based on increments of one hour, you must convert all time to decimal format before multiplying it by their wage to calculate gross pay. To convert from minutes to a decimal, divide the minutes by 60 or refer to the handy chart above.

So, for example, if we use Miranda’s actual time worked (40 hours and 37 minutes), it would convert to 40.62 hours.

If we use Miranda’s rounded time worked (40 hours and 30 minutes), it would convert to 40.50 hours.

With those decimal equivalents in hand, you are then ready to calculate wages paid for regular hours worked and overtime hours worked.

Tips For Calculating Payroll Hours

1) Use 24-Hour Time Format

Standard time format is what you see when you look at most clocks: the time from one to twelve. Recording standard time requires the addition of “a.m.” or “p.m.” to differentiate between morning and afternoon.

Twenty-four-hour time counts the morning hours just like the standard format (e.g., 7:24 a.m., 9:11 a.m., 11:47 a.m., etc.). But after 12:59 p.m., 24-hour time begins counting by adding an hour to twelve. For example, 1:00 p.m. becomes 13:00.

You’ll notice that you don’t need the “p.m.” to indicate afternoon as you do with standard time format. That’s because the other one o’clock (in the early hours of the morning) is written 01:00.

Why is this important? Because it makes figuring out the hours worked (including overtime) much easier if you have to do it manually.

For example, let’s say Miranda clocked in at 9:00 a.m. (standard format) and clocked out at 5:00 p.m. You’re going to have to do some roundabout math to calculate the hours worked because you can’t simply subtract one number from the other.

Now, let’s say that Miranda clocked in at 09:00 (24-hour format) and clocked out at 17:00. Calculating the hours worked becomes a simple matter of subtracting nine from 17 to get eight. Miranda worked eight hours that day.

2) Set A Rounding Policy

Very rarely will every one of your employees clock in and out precisely on the hour. There are going to be some people early and some people late. This is where a rounding policy comes into play.

As we mentioned earlier, the U.S. Department of Labor recommends keeping track of hours worked in fifteen-minute increments. Before calculating payroll hours, determine if you will use a rounding policy and what that will look like.

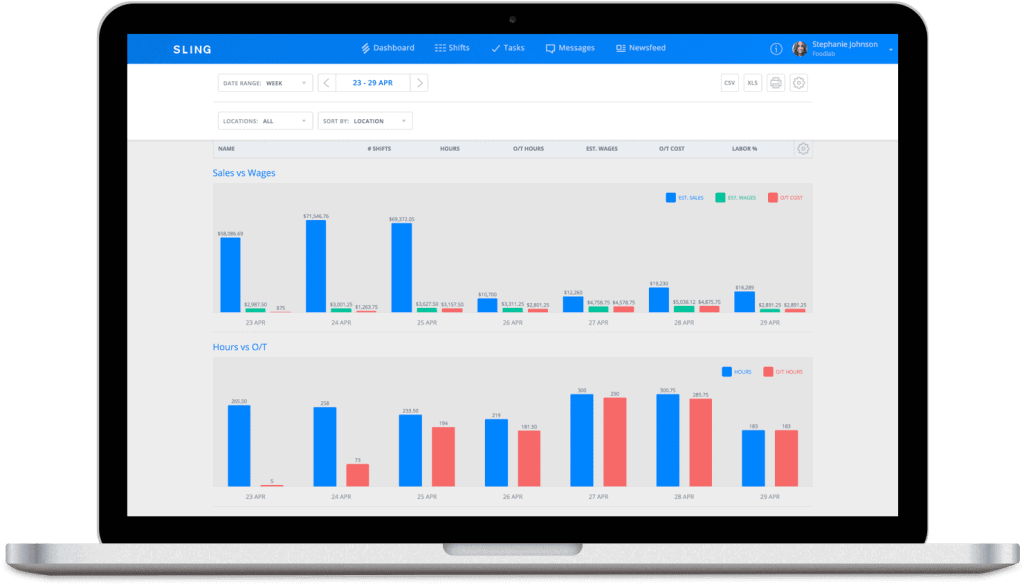

Automate Your Payroll Hours Calculator

Serving as your own payroll hours calculator takes up a lot of your valuable time — time that could be spent growing your business. That’s why it’s all but essential to introduce automation software, such as Sling, into your payroll process.

With Sling, you set the rules that govern work hours time tracking (e.g., rounding or no rounding), and the app does the rest for you.

As employees record their time using the integrated time clock, Sling crunches the number in the blink of an eye. That means less work for you and more accurate data for figuring out the final paycheck.

It also means that work hour data is available anytime you need it — at the beginning of a pay period, in the middle, or right before the end. Such insight helps you better control labor costs and keep your business in the black.

And that’s just the tip of the Sling iceberg!

We mentioned the integrated time clock and the built-in payroll hours calculator, but our software also offers such advanced features as:

- Employee scheduling

- Team communication

- Task management

- Multiple work location control

All of that and much more in a powerful software suite whose components work seamlessly together to provide the most comprehensive workforce management and payroll hours calculator available.

Want to see it for yourself? Try Sling for free today!

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

The post How To Calculate Payroll For Hourly Employees appeared first on Sling.

||----------------------------------------------------------------

By: Sling Team

Title: How To Calculate Payroll For Hourly Employees

Sourced From: getsling.com/blog/payroll-hours-calculator/

Published Date: Fri, 11 Mar 2022 16:29:00 +0000