||

No two businesses are exactly the same. But there is one universal truth that ties them all together: They must all manage payroll in one way or another. And your business is no different.

Whether you’re in charge of a small or a large business, one employee or 100 employees, calculating employee paychecks correctly is one of the most important things you can do to keep your company on the road to success.

In this article, we discuss the correct way to manage payroll so you can set up a system that benefits your team and your business.

Why Manage Payroll

1) Compliance

One of the main reasons it’s important to manage payroll — and to do so correctly — is compliance with local, state, and federal laws.

If your business fails to abide by one or more of the mandates and due dates, it can face significant legal trouble and hefty fines down the road.

2) Employee Morale

Another reason why it’s important to manage payroll accurately every time is employee morale. If your team can’t depend on receiving a correct check on payday, their job satisfaction, productivity, and efficiency will fall.

3) Accuracy

Accuracy is essential in the payroll process. Without it, it’s all too easy to fall outside the bounds of compliance and to cause unnecessary friction between your business and your employees.

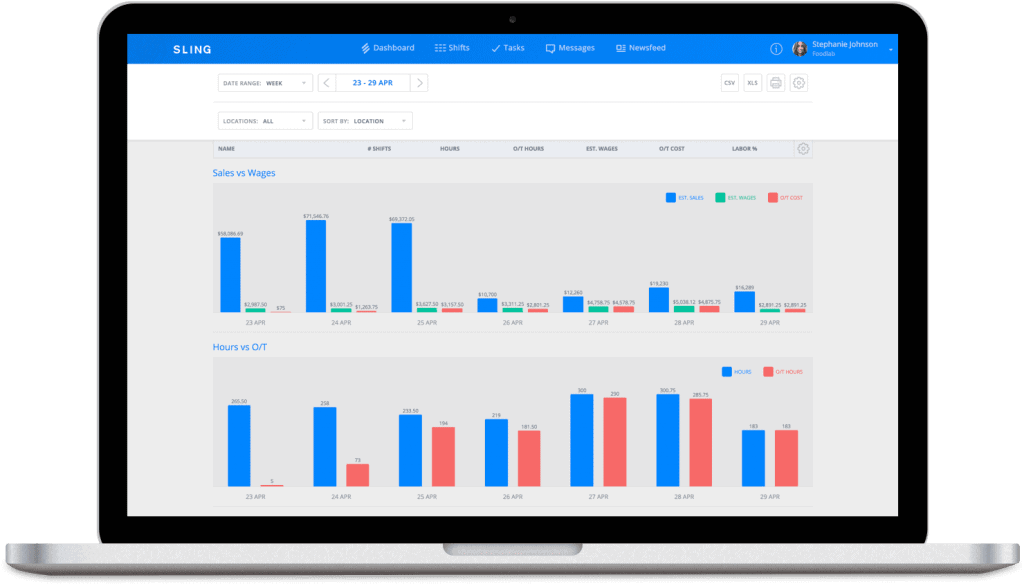

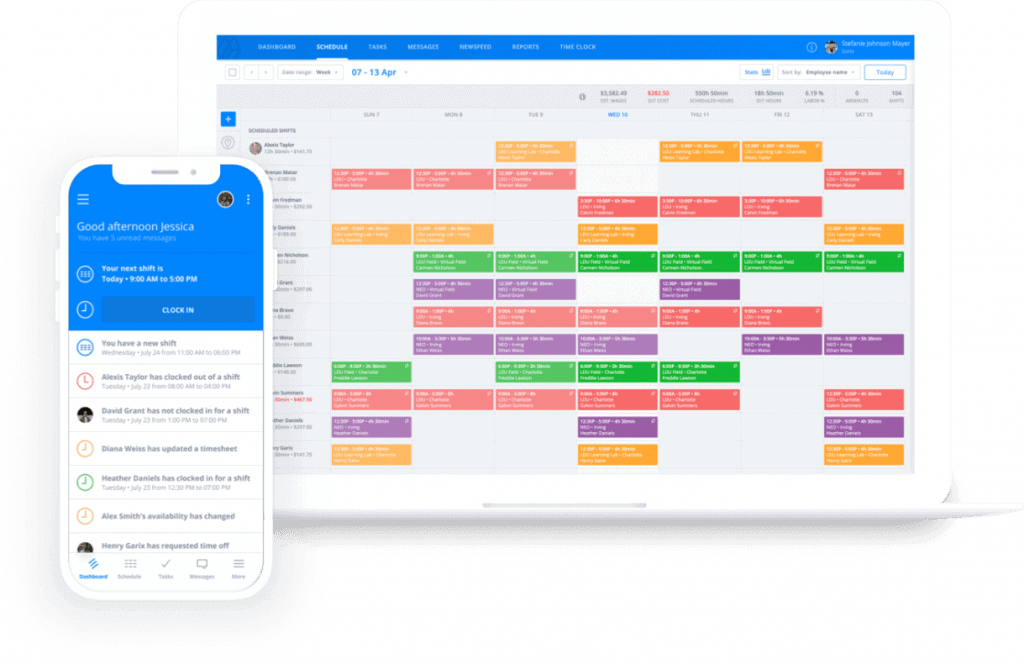

Human error is the biggest cause of miscalculations, missed payments, and other mistakes. You can remove this variable from the equation by automating many of the manual payroll processes with software, such as Sling.

Sling tracks the majority of your team’s necessary data so you can manage payroll without accuracy becoming an issue.

4) Record Keeping

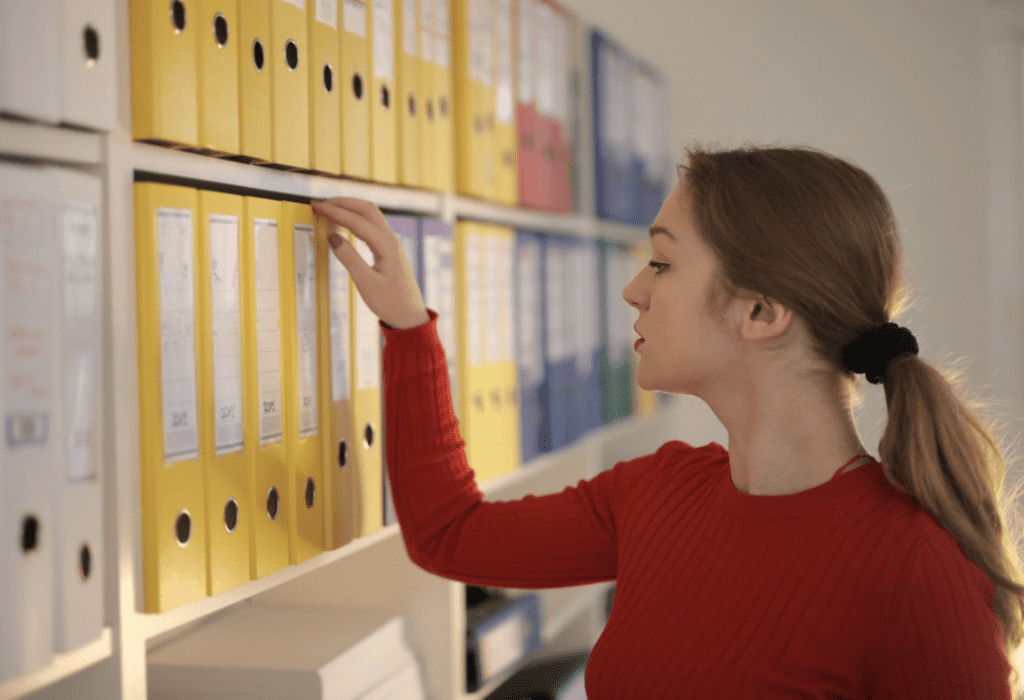

Complying with local, state, and federal payroll laws also involves long-term record keeping.

Government agencies may have questions from time to time, so it’s good to hold on to timesheets, pay stubs, and other wage-related data for at least three years.

5) Time Savings

When you manage payroll correctly and efficiently — or hire another company to do it for you — your business saves time that can be better spent on more important, strategic objectives.

The old adage, “Time is money,” is never more true than when it comes to running payroll. If your payroll process is overly complicated or takes too much time to complete, you are losing time and money that could have been spent growing the business.

How To Manage Payroll

1) Collect Employee Data

Payroll depends on data. So, to manage payroll correctly, the first step involves collecting all of the necessary employee data.

This includes:

- Social Security number

- W-4

- Employee classification (e.g., full-time or part-time)

- Benefits enrollment

- Weekly timesheets

With this information in hand, you’re ready to move on to the meat of managing payroll.

2) Calculate Gross Pay

The hours listed on each employee’s weekly timesheet allow you to calculate their gross pay.

Gross pay is the total regular hours worked times the hourly rate you pay each employee. This yields the total amount of wages before you apply deductions and subtract taxes.

Occasionally, an employee may work overtime (more than 40 hours in a single week). In that case, the federal government mandates that all businesses pay employees who qualify for overtime at a minimum of 1.5 times their regular hourly rate.

So, if employee A works 40 regular hours at $12 per hour and five overtime hours at $18 per hour ($12 x 1.5 = $18), their gross pay would be:

Regular Pay = Regular Hours x Per Hour Rate

Regular Pay = 40 Regular Hours x $12 Per Hour

Regular Pay = $480

Overtime Pay = Overtime Hours x Per Hour Rate

Overtime Pay = 5 Overtime Hours x $18 Per Hour

Overtime Pay = $90

Gross Pay = Regular Pay + Overtime Pay

Gross Pay = $480 + $90

Gross Pay = $570

Gross pay is the number you use to calculate taxes and from which you deduct voluntary and mandatory expenses.

3) Calculate Net Pay

Net pay (a.k.a. take-home pay) is calculated by first deducting any benefits, contributions, and the like from the employee’s gross pay.

Next, withhold federal income tax, payroll taxes (i.e., FICA), and any other state or local taxes and withholdings that apply.

Finally, apply post-tax deductions, if necessary, for some types of benefits, retirement plans, and wage garnishments.

The number you’re left with after all of that is the employee’s net pay. For more details on these important calculations, take a few minutes to read these articles from the Sling blog:

- Gross Pay Vs. Net Pay: The Complete Guide For Managers

- Exempt Vs. Non-Exempt Employees: What’s The Difference?

4) Determine Employer Contributions

Your business is responsible for paying half of the payroll tax total (FICA) calculated in the previous step. It’s also responsible for paying federal and state unemployment taxes.

Depending on where your business is located, other employer contributions may apply. Consult with an attorney or an accountant who is familiar with your industry and the area where your business operates.

5) Pay Employees

This is the step that everyone jumps to when they hear the term manage payroll. But, as we’ve seen, the payroll process actually starts well before cutting checks.

However and whenever you choose to pay your employees (e.g., a paper check on the 15th and 30th of each month, a direct deposit once at the end of every month, or a pay card every week), be sure to do so accurately and consistently.

6) Update Your Records

Once you’ve distributed the paychecks, update your records so that all information is in its proper place.

Depending on how you’ve set up the process and how you manage payroll as a whole, updating your records may involve filing paper pay stubs in the appropriate cabinet or saving a copy of a digital file as a backup.

Either way, it’s vital to maintain accurate records of any payments you make that involve wages, overtime, and other employee activity.

7) Pay The Proper Authorities

The next major step in the payroll process is sending the tax withheld and any employer contributions to the proper authorities.

Such payments are typically due by the 15th of the following month — e.g., May taxes are due by June 15th — but be sure to consult with an attorney or an accountant in your area for more details.

8) File Tax Reports

Finally, the federal government (and some state and local governments) requires businesses to file tax reports every few months (i.e., quarterly) or at the end of the year. Again, be sure to file said reports on time so your business can maintain its compliance.

If taxes and due dates are a speed bump for your business, don’t be afraid to hire an attorney or an accountant to get you started — that’s what they’re there for.

You may have to spend a bit up front, but doing so can save you money, stress, and time down the road and help you avoid running afoul of the IRS.

Streamline Your Payroll With Automation

The best way to manage payroll is with software that helps you with every step of the process. And we’re not just talking about crunching the final numbers.

The Sling app, for example, simplifies payday by streamlining and automating many of the processes that come before it.

With Sling, you can:

- Control labor costs as you create the work schedule

- Create and maintain a labor budget

- Track total work time with the built-in time clock

- Track time-on-task with the very same clock

- Avoid costly overtime

- Much more

You can even export data quickly and easily to integrated tools, such as Gusto and ADP, or produce reports in a variety of formats — both digital and hard copy — and manually transfer them to the payroll processor of your choice.

So, whether you need a tool to help you communicate with your team, organize and control necessary tasks, track time, control labor costs, oversee multiple locations, or manage payroll, Sling is the software for you.

To learn more about how Sling can help you manage your business better, organize and schedule your team, and track and calculate work hours, visit GetSling.com today.

The post How To Easily And Effectively Manage Payroll For Your Business appeared first on Sling.

||----------------------------------------------------------------

By: Sling Team

Title: How To Easily And Effectively Manage Payroll For Your Business

Sourced From: getsling.com/blog/manage-payroll/

Published Date: Mon, 07 Mar 2022 15:56:00 +0000